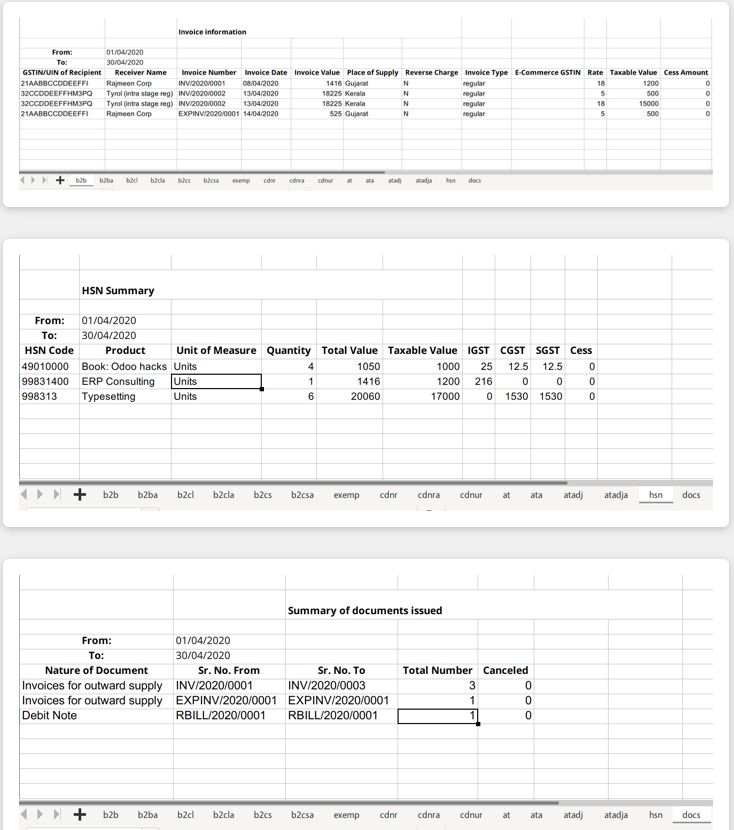

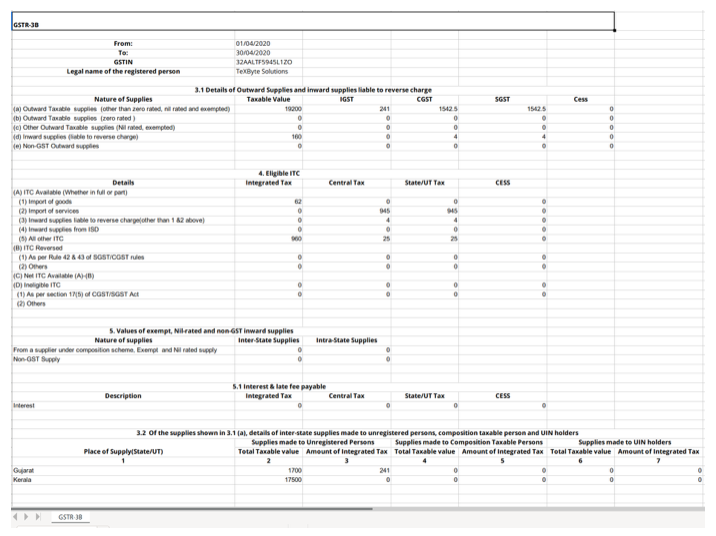

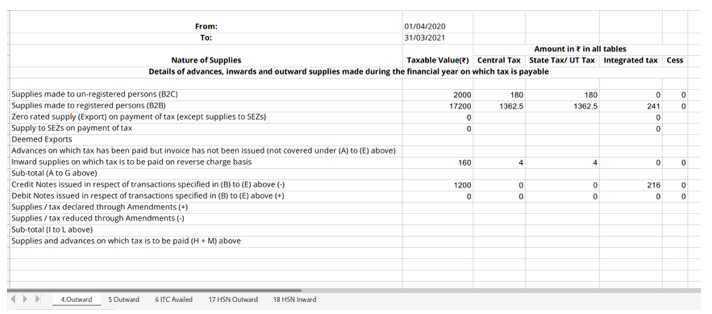

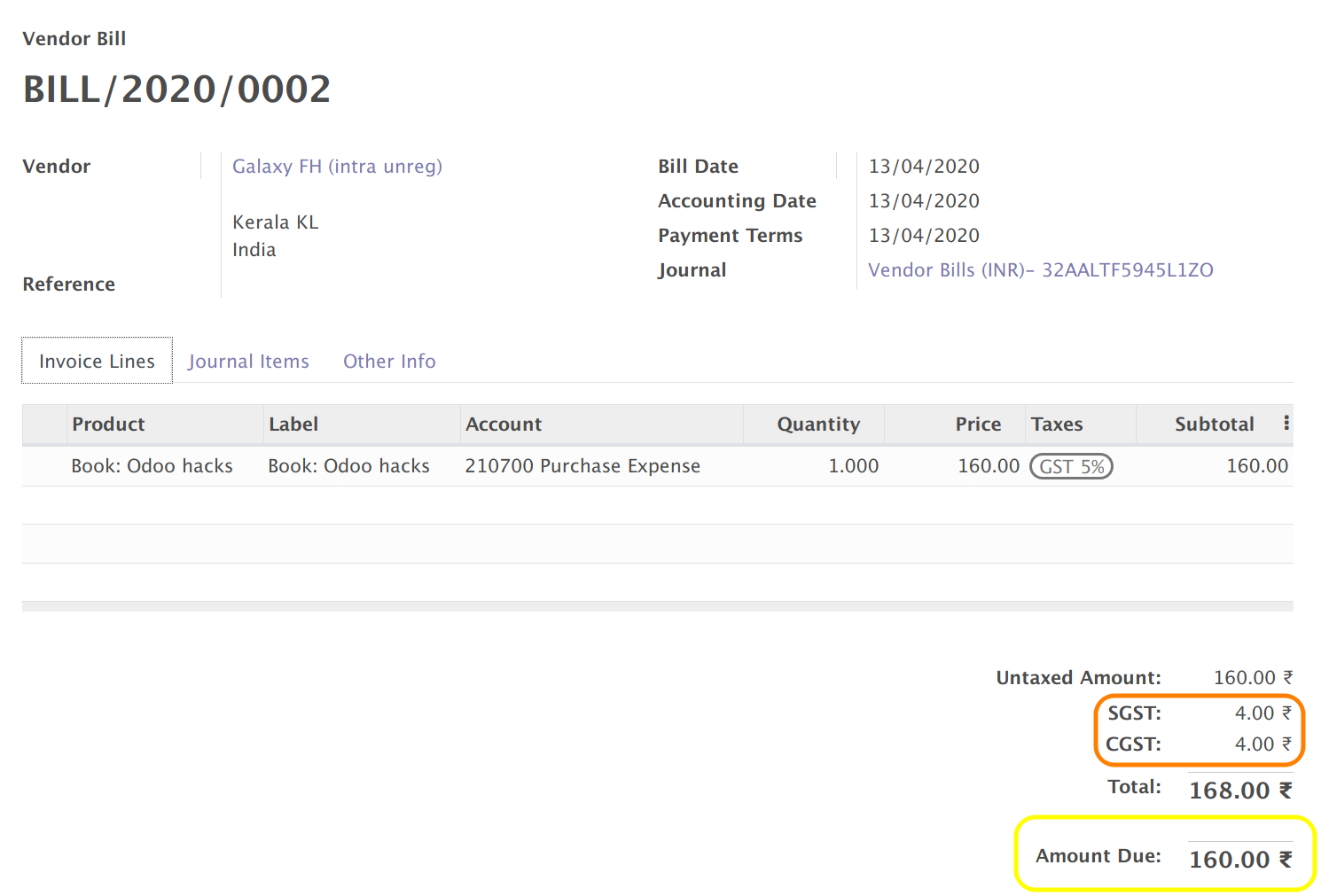

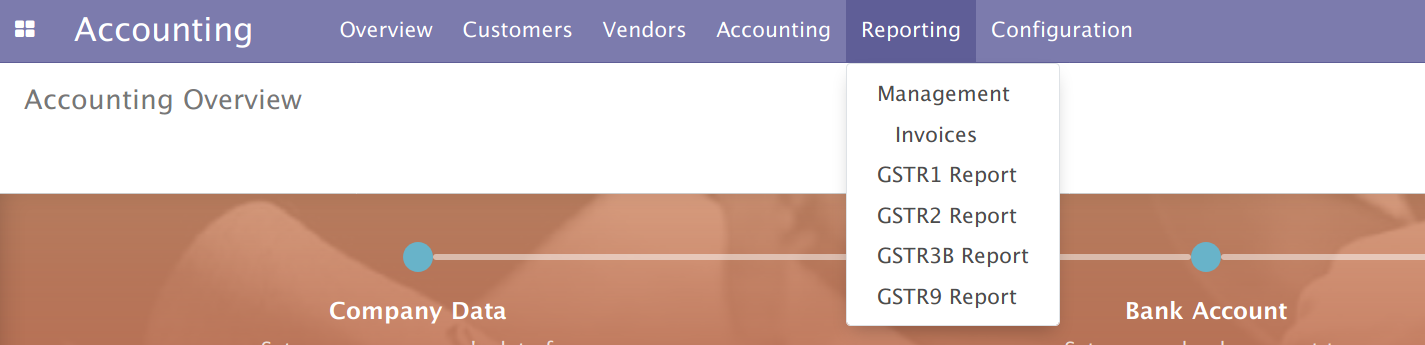

Texbyte GSTR Report consists of GSTR1, GSTR2, GSTR3B & GSTR9 reports complying with the GST Offline Tool and Reverse Charge(works seamlessly with Texbyte GST Solution, probably handled depends on customer configuration).

Download the addon from Odoo Store